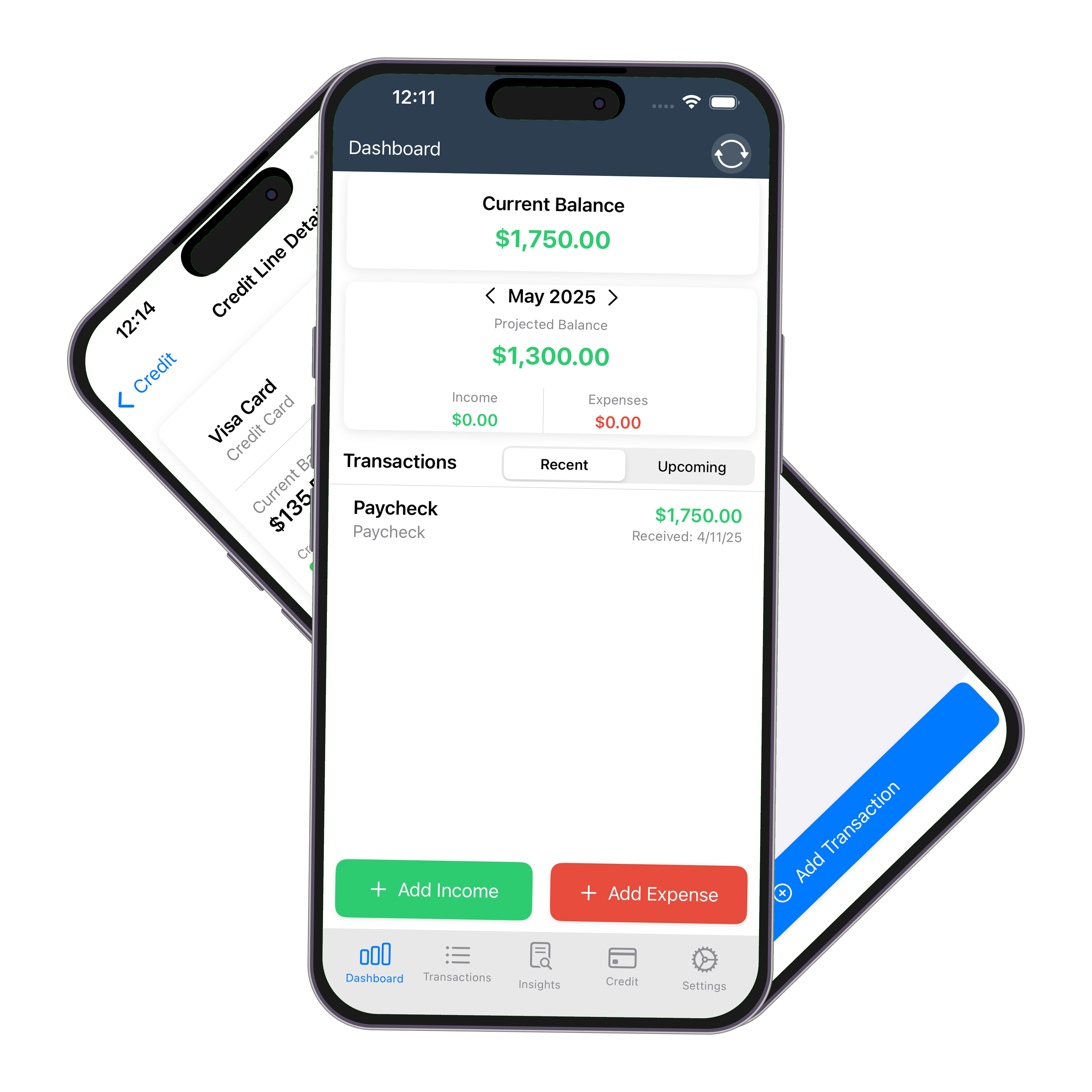

Personal Finances

at Your Fingertips

Take control of your finances with myFinancialTracker

About Us

Our Mission

At myFinancialTracker, we believe that everyone deserves to have control over their financial future. Our mission is to empower individuals and families with the tools and insights they need to make informed financial decisions and achieve their goals.

Our Story

Founded in 2023, myFinancialTracker was born from a simple observation: managing personal finances shouldn't be complicated. Our team of financial experts and technology innovators came together to create a solution that makes financial management accessible, intuitive, and effective for everyone.

Our Values

- Transparency: We believe in clear, honest communication about our services and how we handle your data.

- Security: Your financial data security is our top priority. We use industry-leading encryption and security practices.

- Innovation: We continuously improve our platform to provide the best possible experience for our users.

- Accessibility: We're committed to making financial management tools available to everyone.

Our Team

Our diverse team brings together expertise in finance, technology, and user experience design. We're passionate about creating tools that make a real difference in people's lives.

Join Our Journey

Whether you're just starting your financial journey or looking to take your financial management to the next level, we're here to help. Join thousands of satisfied users who have transformed their financial lives with myFinancialTracker.

Features

Personal Finances at Your Fingertips

myFinancialTracker makes it simple to track all your financial data in one place. With our intuitive interface, you can:

- Categorize expenses automatically

- Track multiple income sources

- Monitor investments in real-time

- Set and track budgets with customizable alerts

- Import transactions from thousands of financial institutions

Our clean design and powerful features make financial management accessible to everyone.

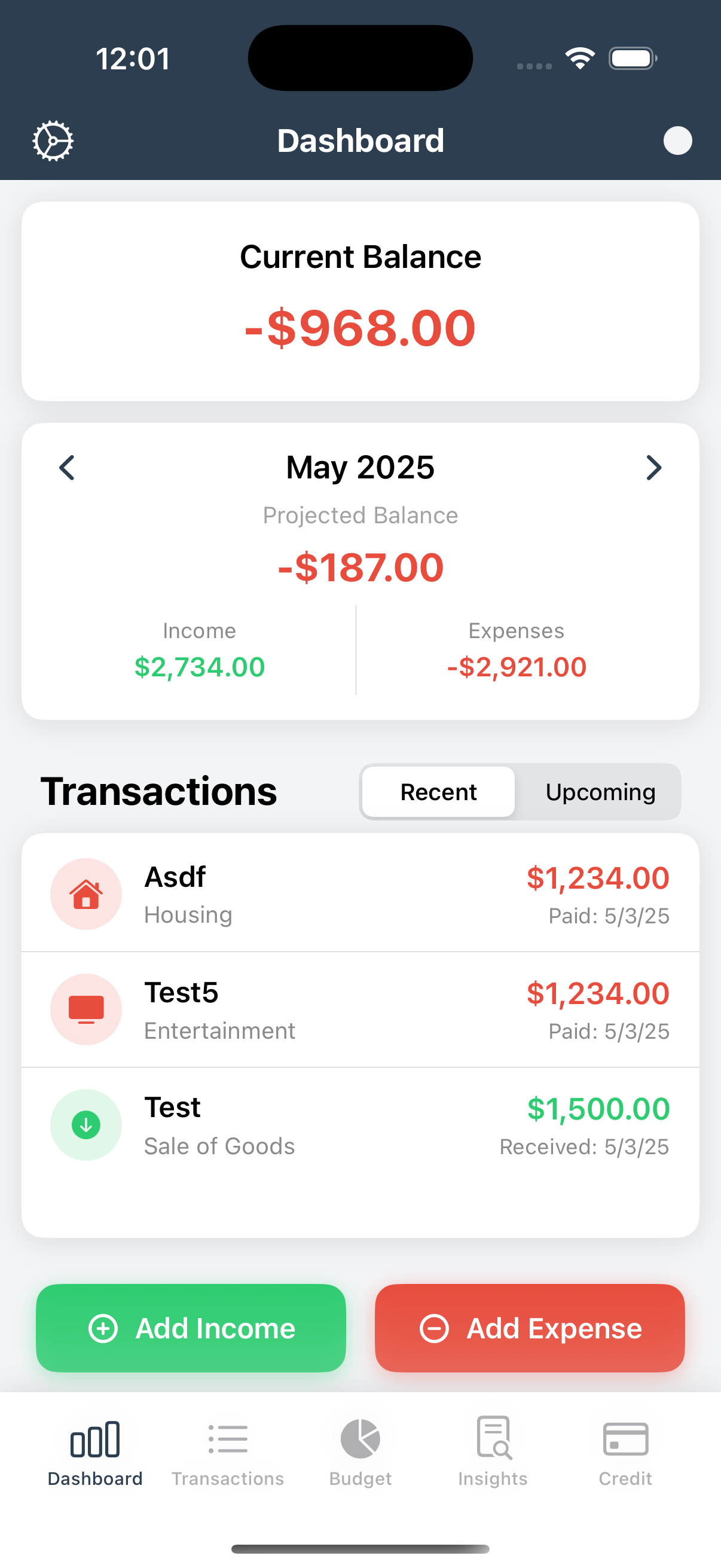

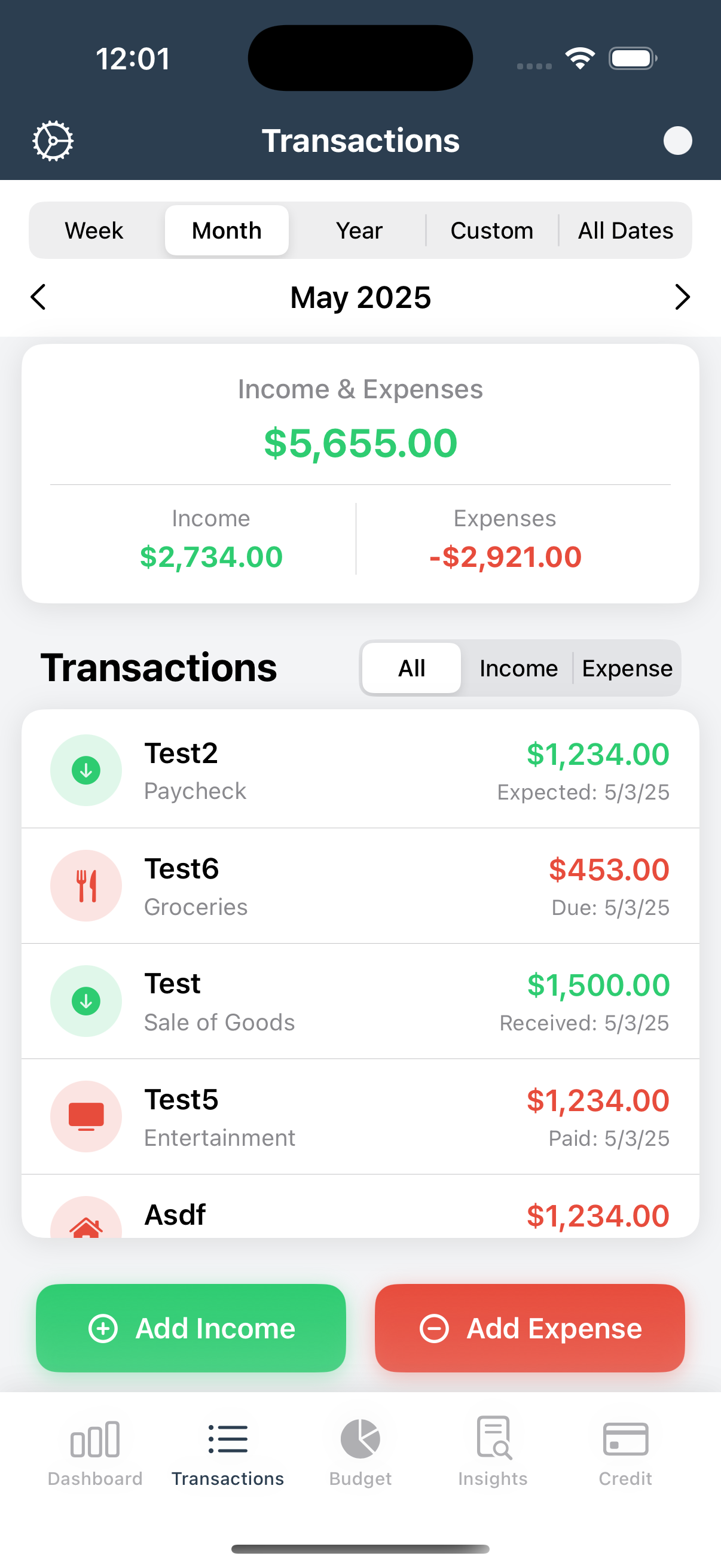

Income & Expense Transactions Tracking

Stay on top of your finances with powerful transaction management:

- Sort and filter your transactions by income or expense

- View current period's income vs. expenses, plus up-to-date totals

- Easily add new income or expense transactions with a single tap

Visualize your financial flow, track your progress, and make informed decisions with ease.

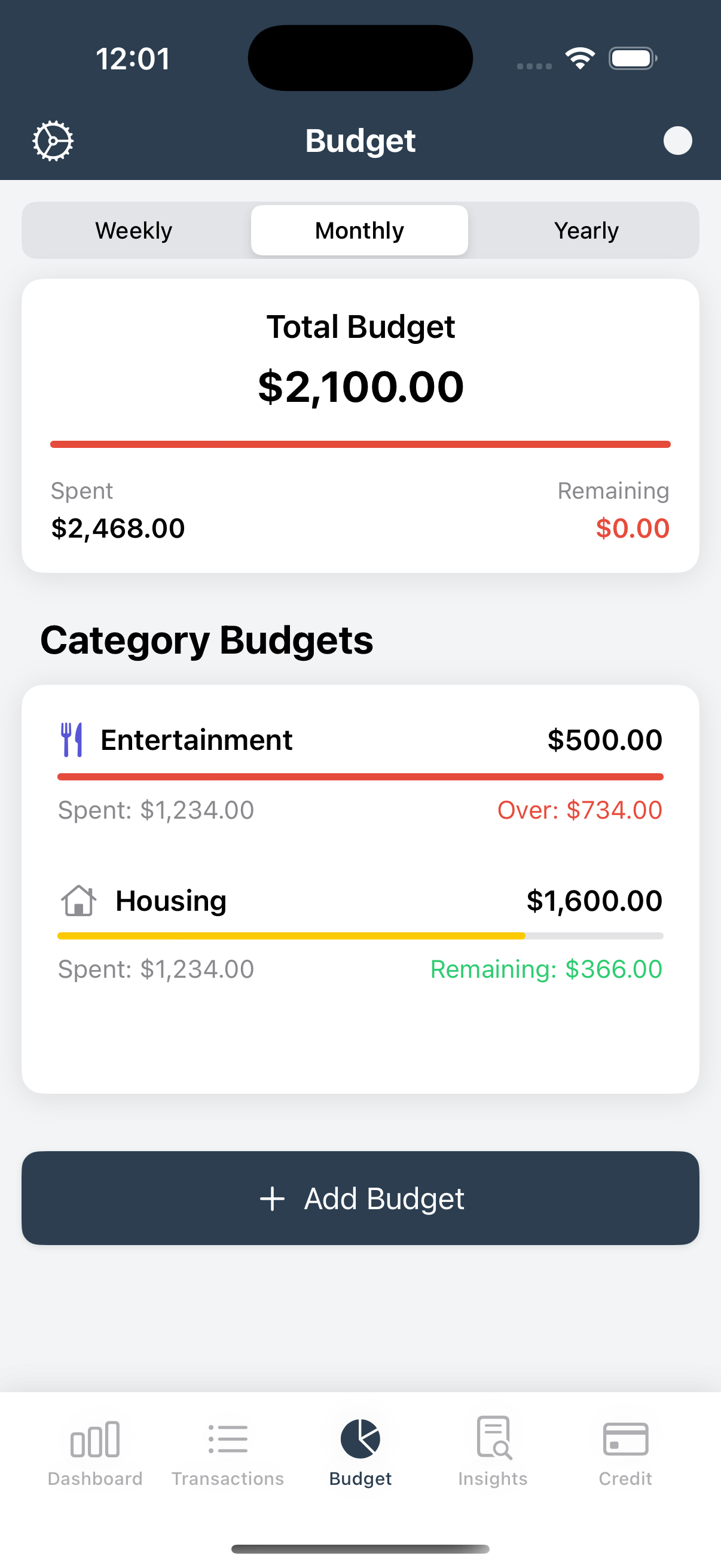

Budget Tracking

Take control of your spending with flexible budget management:

- Create custom budgets for any category

- See both comprehensive and detailed budget breakdowns

- Quickly create new Weekly, Monthly, and Yearly budgets

Stay on track and make smarter financial decisions with clear, visual budget insights.

Financial Insights

Gain valuable insights into your financial health with our advanced analytics:

- Visualize spending patterns with interactive charts

- Identify spending categories that can be optimized

- Track month-to-month changes in your financial position

- Receive personalized recommendations based on your habits

- Compare your finances to anonymized averages for your demographic

Transform raw financial data into actionable insights that help you make better decisions.

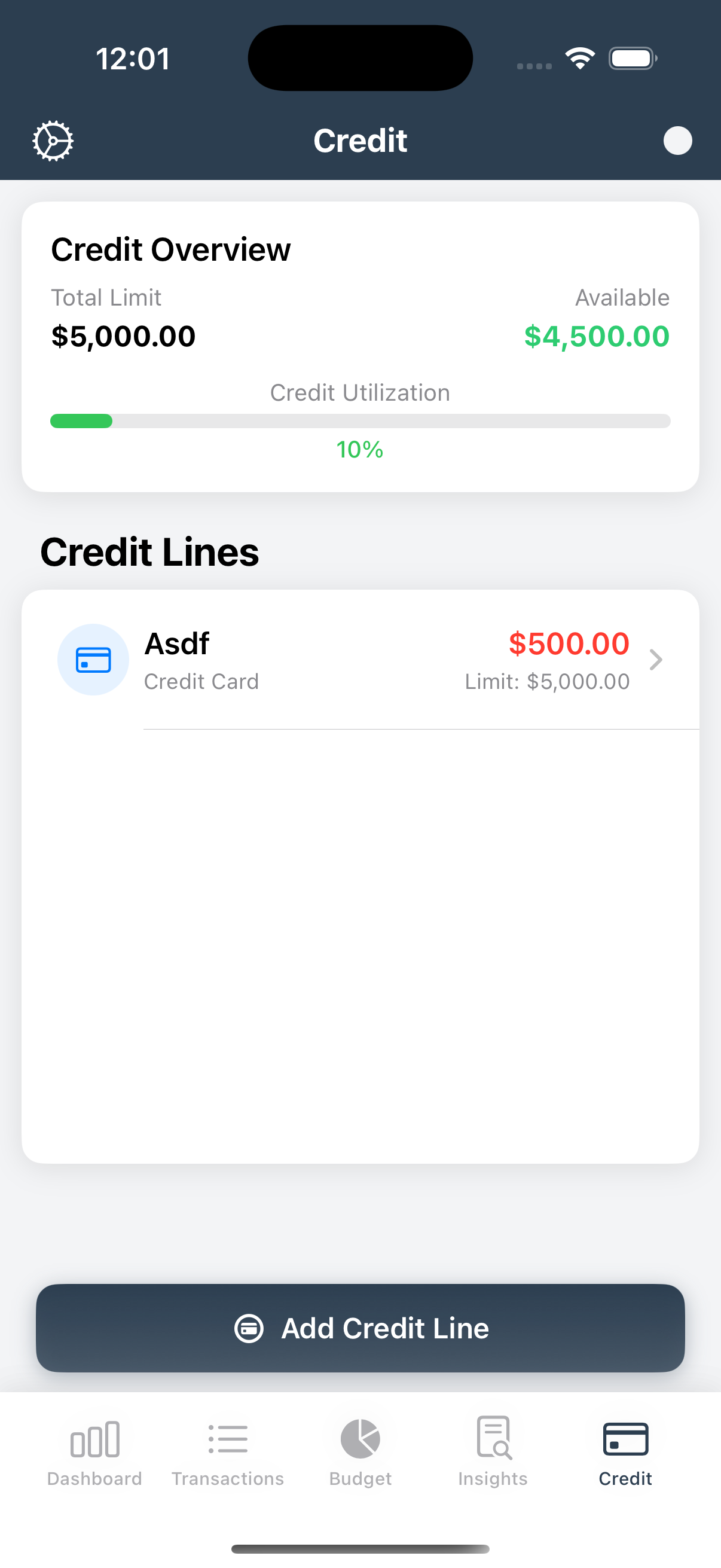

Credit Line Management

Stay on top of your credit with powerful management tools:

- Create and track both credit lines and credit cards

- See comprehensive and detailed credit breakdowns

- Monitor total credit limit, utilization, and available credit at a glance

Gain insights into your credit health and make smarter borrowing decisions.

Financial Projections

Plan for your future with confidence using our powerful projection tools:

- Create multiple financial scenarios and compare outcomes

- Model the impact of major life events on your finances

- Project retirement savings with adjustable parameters

- Visualize debt payoff strategies and timelines

- Forecast cash flow for the next 12 months

Move beyond reactive financial management to proactive financial planning with our projection tools.

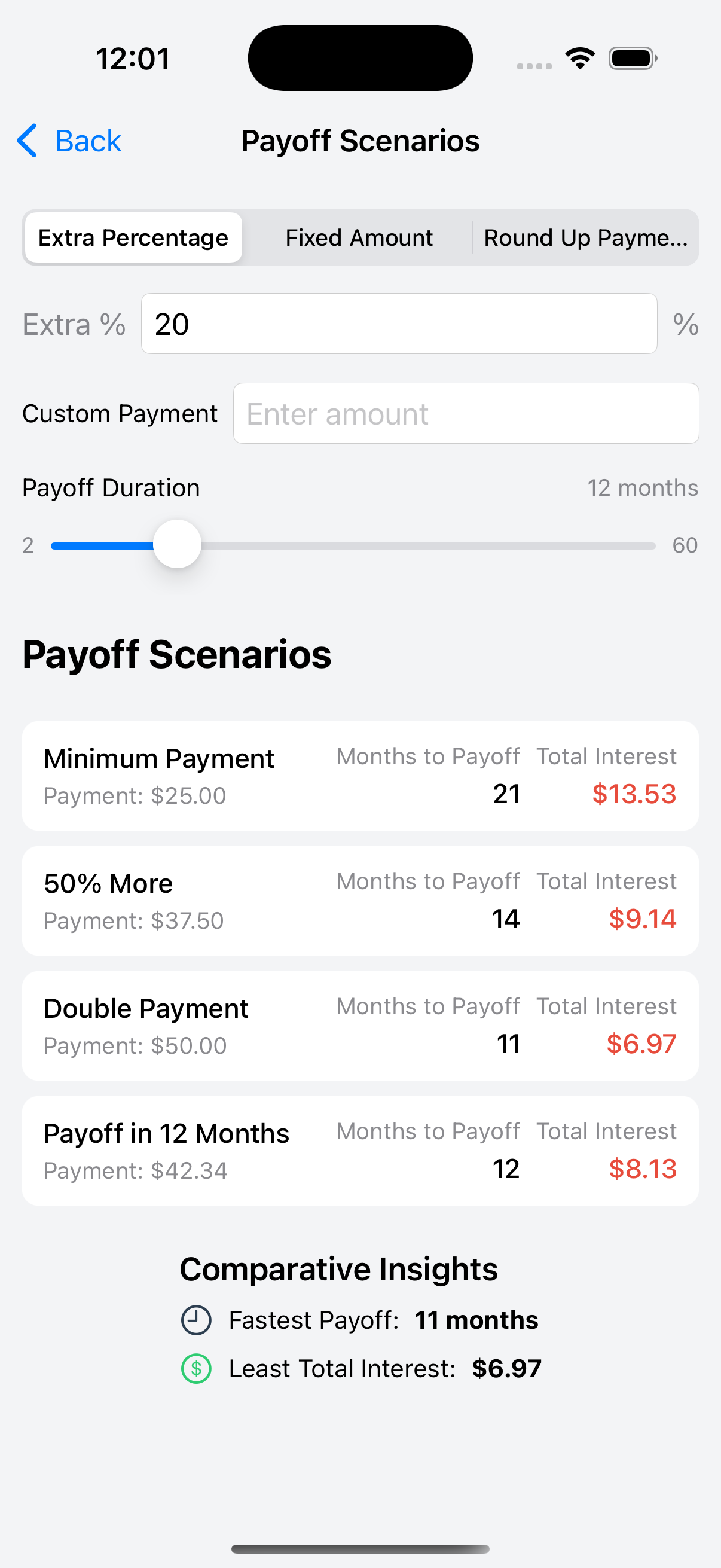

Credit Card & Loan Analysis

Optimize your debt management strategy with our comprehensive analysis tools:

- Compare different debt payoff strategies (snowball vs. avalanche)

- Calculate interest savings from consolidation or refinancing

- Monitor credit utilization across all accounts

- Receive alerts about high-interest charges

- Get personalized recommendations for optimizing your debt

Take control of your debt and save thousands in interest with our smart analysis and recommendations.

Recurring Transactions

Never miss a bill or subscription payment with our recurring transaction management:

- Automatically detect recurring bills and subscriptions

- Receive reminders before payments are due

- Track subscription spending and identify opportunities to save

- Schedule automatic payments for recurring expenses

- Get notified about price increases in your subscriptions

Simplify your financial life by automating the tracking and management of your recurring transactions.

What Our Users Say

Get Started Today

Free

- Basic financial tracking

- Single account

- 30-day history

Individual Plan

- Personal financial tracking

- Single user account

- Full history access

- Budgeting tools

- Financial Projections

Companion Plan

- All Individual Plan features

- Share with one person

- Joint account tracking

- Shared budgeting

- Income & expense sharing

Family Plan

- All Companion Plan features

- Share with up to 5 people

- Family budget management

- Children's accounts

- Financial education tools

Frequently Asked Questions

What is myFinancialTracker?

myFinancialTracker is a powerful iOS app that helps you manage your personal finances with ease. It offers features like expense tracking, family sharing, financial insights, projections, debt analysis, and more.

How secure is my financial data?

We take security seriously. All your data is encrypted with military-grade encryption both during transmission and when stored in our database. We never share your financial information with third parties without your explicit consent.

Can I cancel my subscription at any time?

Yes, you can cancel your subscription at any time from your account settings. Your subscription will remain active until the end of your current billing period.

How does family sharing work?

With family sharing, you can invite up to 4 family members (for Premium) or 10 team members (for Business) to view and manage shared financial accounts. You have full control over what information each member can access.

Which financial institutions can I connect to?

myFinancialTracker connects to over 10,000 financial institutions worldwide, including major banks, credit card companies, investment platforms, and more. If you have trouble connecting to a specific institution, please contact our support team.

Is there a free version available?

We offer a 14-day free trial for all new users. After the trial period, you'll need to choose one of our subscription plans to continue using the app. We don't currently offer a permanent free tier.

Support & Suggestions

Have a question or suggestion? We'd love to hear from you! Fill out the form below and our team will get back to you as soon as possible.

My Account

Account Overview

user@example.com

Member Since

January 1, 2023

Subscription

Premium (Yearly) - Renews on Jan 1, 2024

Billing Information

Payment Method

Visa ending in 4242

Expires 12/25

Recent Charges

| Date | Description | Amount | Status |

|---|---|---|---|

| Jan 1, 2023 | Premium Plan (Yearly) | $95.90 | Paid |